This one will be briefer than sometimes as I want to focus on some new topics (on which I will post in the future).

In summary, headline consumer price level increases seem to be slowing markedly following their sharp early 2009 rebound from the late 2008 plunge levels. Clearly we have not followed the path of Great Depression deflation, but the US price level trend appears to be flattening out much sooner than occurred in Japan, as the graphs below show. While mild deflation may be more probable, we could still be at some risk of a sharp price deflation, in part because commodity prices in particular seem (to this observer among others) to have risen too far too fast. A lot may hinge on the combined questions of (1) how much investor speculation in commodities (which is subject to quicker reversal than end-user demand is) has impacted their prices, and (2) how much and how abruptly China's growth slows. Though of course other factors such as the direction of broader asset prices (stocks, housing) and government policy are also very relevant to the CPI outlook.

These are my definition related comments from a previous post:

As noted previously, "deflation" is often discussed in broader terms than simply price level:Some Relevant Current ArticlesThe various measures are often somewhat correlated but they only track to each other loosely. In the Great Depression prices fell faster than wages, yet wages (along with asset prices) still fell enough to propagate the adverse feedback loop of debt deflation in which income falls but debt obligations remain at the same nominal level, increasing the burden of the debt. Deflation in asset prices (triggered by the bursting of debt-financed asset bubbles) generally precedes the other deflationary trends.

- Contraction of money and credit (broad money supply)

- Deflation in asset prices

- Deflation in a representative "basket" of consumer and producer prices

- Deflation in wages

- Breakfast with Dave Jan 18th (free registration required) - David Rosenberg provides lots of individual graphs of trends in components of the CPI.

- CPI, Rents and Real Earnings

- Inflation is Not an Issue... - Nice graph of component contributions.

- Apartment Vacancy Rate Highest on Record, Rents Plunge - The housing components of the index (which are based on surveys) still seem to lag reality.

- Tanker Glut! - Evidence of speculative "inventory"?

- “Financial Reform, or, Rearranging Chairs on the Titanic” - "Note that a large portion of commodities futures are run through formal exchanges without dampening the speculation that is driving yet another commodities boom that will go bust next year."

- Debtwatch No 41, December 2009: 4 Years of Calling the GFC - "If a similar effect applied this time and deflation drove private debt levels to 400% of GDP, it would only take a 6% rate of deflation to put America in the same position it was in in 1932."

- China to curb lending binge, regulator says

- China Faces Crash Scenario - China's current credit boom appears to be contributing to commodity demand via both increased economic activity and actual consumer hording of commodities, and a slowing or reversal could have global price impacts.

- Contrarian Investor Predicts Crash in China

CPI-U 12 Month Changes (source: BLS)

(click on chart for a larger version in a new window)

I think the year-on-year graph is deceptive when prices are as volatile as they have been. Compare it to the price level trend graphs below.

BLS Summary Comments:

"On a seasonally adjusted basis, the December Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the index increased 2.7 percent before seasonal adjustment.

The seasonally adjusted increase in the all items index was broad based, with the indexes for food, energy, and all items less food and energy all posting modest increases. Within the latter group, a sharp rise in the index for used cars and trucks was the largest contributor to the 0.1 percent increase, while the indexes for airline fares, apparel, and lodging away from home rose as well. In contrast, the indexes for rent and owners' equivalent rent were unchanged and the index for new vehicles declined.

Grocery store food indexes showed broad-based increases, leading to the food index rising 0.2 percent, its largest one-month advance in over a year. The energy index also rose 0.2 percent; this was its smallest increase in five months. The indexes for fuel oil and gasoline rose, but the electricity index was unchanged and the natural gas index declined."

16% Trimmed CPI

This chart of 16% trimmed mean CPI (generated from the Cleveland Fed site) removes the most extreme monthly price changes:

Consumer Price Index Trends: Great Depression versus Today through December 2009 (US)

Components of US Consumer Price Index (May 1927 - Dec 1937, Great Depression)

(Note: This chart is unchanged from past posts)

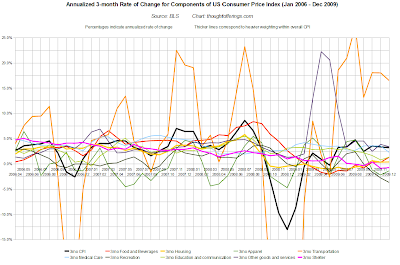

Components of US Consumer Price Index (January 2006 - December 2009)

Annualized 3-Month Rate of Change for Components of US Consumer Price Index (April 2006 - December 2009)

The above chart shows the rate of change (over a sliding three month period) of the components whose absolute price levels are shown in the previous chart. I also added the magenta line for shelter (even though it is contained within the yellow housing measure) to better show the effect of declining rents and owners' equivalent rents separated from other housing components such as energy.

Price Index Changes: Great Depression CPI versus Current PPI through December 2009 (US)

Consumer Price Index Trends: 1990s Japan versus US Today (through December 2009) and US Great Depression

Note that the year on year graph higher up is deceptive, as inflation seems to be slowing much faster than occurred in Japan post-1990.

CPI in Japan (Jan 1980 - Jul 2009)

From previous posts: "The peak of Japan's CPI occurred in October 1998, almost eight years after the stock market peaked, and Japan's notorious mild deflation has been in effect since then. A multi-year disinflation (of core CPI) leading to sustained mild deflation is one possible outcome for the US.

Factors Contributing to Deflation

I had included a series of graphs of factors that contribute to price deflation such as capacity, wages, etc. I may re-include these in the future, time permitting and if they are of interest.

No comments:

Post a Comment